MARKETING THEORIES

- Ansoff Matrix

- Balanced Scorecard

- The Marketing Mix

- The Communications Mix

- SWOT Analysis

- Stakeholder Mapping

- The consumer decision making process

- Porters Five Forces

- The GE Matrix

- The Marketing Environment

- Segmenting consumer markets

- Maslow’s hierarchy of needs

- Boston Consulting Group Matrix

- PESTEL Analysis

- RABOSTIC planning model

- The PESO model

What is the Ansoff Matrix?

The Ansoff Matrix, also called the Product/Market Expansion Grid, is a tool used by firms to analyze and plan their strategies for growth. The matrix shows four strategies that can be used to help a firm grow and also analyzes the risk associated with each strategy. Learn more about business strategy in CFI’s Business Strategy Course.

Understanding the Ansoff Matrix

The matrix was developed by applied mathematician and business manager, H. Igor Ansoff, and was published in the Harvard Business Review in 1957. The Ansoff Matrix has helped many marketers and executives better understand the risks inherent in growing their business.

The four strategies of the Ansoff Matrix are:

- Market Penetration: This focuses on increasing sales of existing products to an existing market.

- Product Development: Focuses on introducing new products to an existing market.

- Market Development: This strategy focuses on entering a new market using existing products.

- Diversification: Focuses on entering a new market with the introduction of new products.

Of the four strategies, market penetration is the least risky, while diversification is the riskiest.

The Ansoff Matrix: Market Penetration

In a market penetration strategy, the firm uses its products in the existing market. In other words, a firm is aiming to increase its market share with a market penetration strategy.

The market penetration strategy can be executed in a number of ways:

- Decreasing prices to attract new customers

- Increasing promotion and distribution efforts

- Acquiring a competitor in the same marketplace

For example, telecommunication companies all cater to the same market and employ a market penetration strategy by offering introductory prices and increasing their promotion and distribution efforts.

The Ansoff Matrix: Product Development

In a product development strategy, the firm develops a new product to cater to the existing market. The move typically involves extensive research and development and expansion of the company’s product range. The product development strategy is employed when firms have a strong understanding of their current market and are able to provide innovative solutions to meet the needs of the existing market.

This strategy, too, may be implemented in a number of ways:

- Investing in R&D to develop new products to cater to the existing market

- Acquiring a competitor’s product and merging resources to create a new product that better meets the need of the existing market

- Forming strategic partnerships with other firms to gain access to each partner’s distribution channels or brand

For example, automotive companies are creating electric cars to meet the changing needs of their existing market. Current market consumers in the automobile market are becoming more environmentally conscious.

The Ansoff Matrix: Market Development

In a market development strategy, the firm enters a new market with its existing product(s). In this context, expanding into new markets may mean expanding into new geographic regions, customer segments, etc. The market development strategy is most successful if (1) the firm owns proprietary technology that it can leverage into new markets, (2) potential consumers in the new market are profitable (i.e., they possess disposable income), and (3) consumer behavior in the new markets does not deviate too far from that of consumers in the existing markets.

The market development strategy may involve one of the following approaches:

- Catering to a different customer segment

- Entering into a new domestic market (expanding regionally)

- Entering into a foreign market (expanding internationally)

For example, sporting goods companies such as Nike and Adidas recently entered the Chinese market for expansion. The two firms are offering roughly the same products to a new demographic.

Learn more about strategy in CFI’s Business Strategy Course.

The Ansoff Matrix: Diversification

In a diversification strategy, the firm enters a new market with a new product. Although such a strategy is the riskiest, as both market and product development are required, the risk can be mitigated somewhat through related diversification. Also, the diversification strategy may offer the greatest potential for increased revenues, as it opens up an entirely new revenue stream for the company – accesses consumer spending dollars in a market that the company did not previously have any access to.

There are two types of diversification a firm can employ:

1. Related diversification: There are potential synergies to be realized between the existing business and the new product/market.

For example, a leather shoe producer that starts a line of leather wallets or accessories is pursuing a related diversification strategy.

2. Unrelated diversification: There are no potential synergies to be realized between the existing business and the new product/market.

For example, a leather shoe producer that starts manufacturing phones is pursuing an unrelated diversification strategy.

BALANCED SCORECARD

What is a Balanced Scorecard?

The Balanced Scorecard (or balance score card) is a strategic performance measurement model which is developed by Robert Kaplan and David Norton. Its objective is to translate an organization’s mission and vision into actual (operational) actions (strategic planning).

In addition, it can help provide information on the chosen strategy more, manage feedback and learning processes and determine the target figures. The (operational) actions are set up with measurable indicators that provide support for understanding and adjusting the chosen strategy. The starting points of the balanced scorecard are the vision and the strategy that are viewed from four perspectives: the financial perspective, the customer perspective, the internal business processes and learning & growth.

Financial perspective

The financial perspective is important for all shareholders and other financial backers of an organization. It answers the question: “How attractive must we appear to our shareholders and financial backers?”. This is mainly a quantitative benchmark based on figures from the past.

In addition, it provides a reliable insight into the operational management and the sustainability of the chosen strategy. The delivered added value from the other three perspectives will be translated into a financial success. This is therefore a quantification of the added value that is delivered in the organization. After all in the balanced scorecard, when there is a higher added value, the profits will also be higher.

Customer perspective

Each organization serves a specific need in the market. This is done with a target group in mind, namely its customers. Customers determine for example the quality, price, service and the acceptable margins on these products and/or services.

Organizations always try to meet customer expectations that may change at any time. The existence of alternatives (those of the competitor) has a large influence on customer expectation. This perspective answers the question: “How attractive should we appear to our customers?”

Internal Business Processes

From the perspective of internal processes the question should be asked what internal processes have actually added value within the organizations and what activities need to be carried out within these processes.

Added value is mainly expressed as the performance geared towards the customer resulting from an optimal alignment between processes, activities and decisions. This perspective answers the question: “What must we excel at to satisfy our customers and shareholders/ financial backers?”

Learning and growth

An organization’s learning ability and innovation indicate whether an organization is capable of continuous improvement and/or growth in a dynamic environment. This dynamic environment is subject to change on a daily basis due to new legislation and regulations, economic changes or even increasing competition. This perspective answers the question: “How can we sustain our ability to achieve our chosen strategy?”.

The balance within

As the name suggests, the equilibrium or balance is an important principle in the balanced scorecard model.

There must be a balance between the short-term and the long-term objectives, financial and non-financial criteria, leading and lagging indicators and external and internal perspectives. It is about cohesion in which an improvement in one perspective must not be an obstacle in another perspective.

This cohesion is reflected in the model through the mutually connected arrows between the four perspectives.

Balanced Scorecard implementation

The implementation of the Balanced Scorecard consists of a number of steps. The first step in this is that senior management sets up a mission, vision and strategy. This strategy is linked to a number of objectives which are referred to as strategic objectives.

Then middle management is informed about the mission, vision and the strategic objectives. In an open discussion, managers can express their opinions, indicate the critical success factors per perspective and they can point out or set up indicators themselves so that these can be monitored in the future.

For the financial and customer perspectives within the Balanced Scorecard it is possible to carry out a survey or conduct interviews among the (potential) shareholders or customers to assess what their expectations are. This could provide an insight into the direction of the objectives the necessary objectives.

In consultation with middle management and senior management several objectives are formulated in which the different critical success factors are indicated per objective, the indicators are used to measure this, specific values such as targets and initiatives are meant to achieve these objectives.

It is possible to go one step further by linking personal objectives to the objectives of middle management. As a result, all personal initiatives will contribute to the chosen strategy of the organization. The implementation of the Balanced Scorecard can be carried out in different manners.

Broadly, this could include the following steps:

- Set up a vision, mission and strategic objectives.

- Perform a stakeholder analysis to gauge the expectations of customers and shareholders.

- Make an inventory of the critical success factors

- Translate strategic objectives into (personal) goals

- Set up key performance indicators to measure the objectives

- Determine the values for the objectives that are to be achieve

- Translate the objectives into operational activities.

It is important to mention that achieving strategic objectives is a continuous process: plan-do-check-act (see PDCA- or Deming circle). Setting up and implementing the Balanced Scorecard model is therefore not a one-off action!

Balanced Scorecard template

Start translating an organization’s mission and vision into actual action with this ready to use Balanced Scorecard template.

THE 7 P’S OF THE MARKETING MIX

MARKETING THEORIES – THE COMMUNICATIONS MIX

Visit our Marketing Theories Page to see more of our marketing buzzword busting blogs.

The communications mix involves all the tools you use to communicate with your customers or potential customers. This could be through advertising, social media, product packaging, direct marketing, websites, events, exhibitions – the list goes on!

Successful campaigns consider all elements of the communications mix. To see even better results, you must effectively use all areas to create an integrated multi-channel or omni-channel campaign.

What’s the difference between the marketing communications mix and the marketing mix?

They may both include mix in their names, and they do link together – but they are actually very different tools.

On one hand, the Marketing Mix is used to shape brand strategies through factors unique to each business (the 7 Ps – product, price, promotion, place, physical evidence, people and process).

On the other hand, the Communications Mix defines the ways you communicate with your customers, i.e. the tools you use.

Marketing communications tools

The promotional mix is made up of five elements, shown below:

1. Advertising (TV, radio, press, PPC)

Advertising covers all avenues where a business pays for their message to be broadcast.

In 1922, the first radio advertisement was aired in New York, promoting apartments in Jackson Heights. Video came next, but luckily, it didn’t quite kill the radio star. Instead, it became its own highly effective advertising tool, working harmoniously alongside radio.

Television has mostly been confined to brands with deep pockets. However, with the digital age came more affordable online tools such as PPC and social media advertising.

Successful advertising campaigns can be emotive, creative, eye-catching, catchy, musical, or even intentionally annoying (anything to grab attention!)

2. Direct marketing & digital marketing (email, social media, gamification, etc)

The emergence of digital didn’t just bring social media and online shopping. It also gave us a whole new way to do marketing. This way is significantly cheaper; and if done correctly can be even more effective than broadcasting to the masses through TV or radio.

One of the major benefits of direct marketing is its targeted approach. So, if you’ve done the best and most accurate market research on your customers, you’ll know exactly who to target. It’s also attractive to marketers because its results can be directly measured.

3. Public relations (PR)

Public relations turns brand messages into stories that appeal to the media and its target audiences. It amplifies news, strategies and campaigns to create a positive view of a company through partnerships with newspapers, journalists and other relevant organisations.

But not everything can be shared via PR. The idea is to separate the stories they think could be developed into an effective PR strategy. So, usually anything considered too ‘salesy’ is a no no. A great PR campaign revolves around a public interest, current event or trend that can be connected to a product, service or brand.

4. Personal selling

Personal selling is, you guessed it, selling through a person (usually in a face-to-face setting). This includes salespeople, representatives, brand ambassadors or even influencers.

Using their experience, specialist knowledge and communication skills, their aim is to inform and encourage customers to buy or try a product or service.

5. Sales promotion

Sale! 50% off selected lines!

Using various online and offline outlets, sales promotion creates limited time deals or promotions on products or services in order to increase short-term sales. It can include sales, coupons, contests, freebies, prizes and product samples.

When conducting a sales promotion, it’s important to consider:

- how much it costs and whether the volume of sales will make up for the lost revenue

- whether it will build loyalty or just attract one-off purchasers

- if the promotion fits with the brand’s image

Loyalty cards are a more recent addition to the sales promotion sphere, adding important elements such as customer retention and brand loyalty. Discounts or special offers reward loyal and repeat purchasers. It’s also a great way to gather valuable customer data on purchasing habits and behaviour.

SWOT ANALYSIS

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Strengths and weaknesses are internal to your company—things that you have some control over and can change. Examples include who is on your team, your patents and intellectual property, and your location.

Opportunities and threats are external—things that are going on outside your company, in the larger market. You can take advantage of opportunities and protect against threats, but you can’t change them. Examples include competitors, prices of raw materials, and customer shopping trends.

A SWOT analysis organizes your top strengths, weaknesses, opportunities, and threats into an organized list and is usually presented in a simple two-by-two grid. Go ahead and download our free template if you just want to dive right in and get started.

Why do a SWOT Analysis?

When you take the time to do a SWOT analysis, you’ll be armed with a solid strategy for prioritizing the work that you need to do to grow your business.

You may think that you already know everything that you need to do to succeed, but a SWOT analysis will force you to look at your business in new ways and from new directions. You’ll look at your strengths and weaknesses, and how you can leverage those to take advantage of the opportunities and threats that exist in your market.

Who should do a SWOT Analysis?

For a SWOT analysis to be effective, company founders and leaders need to be deeply involved. This isn’t a task that can be delegated to others.

But, company leadership shouldn’t do the work on their own, either. For best results, you’ll want to gather a group of people who have different perspectives on the company. Select people who can represent different aspects of your company, from sales and customer service to marketing and product development. Everyone should have a seat at the table.

Innovative companies even look outside their own internal ranks when they perform a SWOT analysis and get input from customers to add their unique voice to the mix.

If you’re starting or running a business on your own, you can still do a SWOT analysis. Recruit additional points of view from friends who know a little about your business, your accountant, or even vendors and suppliers. The key is to have different points of view.

Existing businesses can use a SWOT analysis to assess their current situation and determine a strategy to move forward. But, remember that things are constantly changing and you’ll want to reassess your strategy, starting with a new SWOT analysis every six to 12 months.

For startups, a SWOT analysis is part of the business planning process. It’ll help codify a strategy so that you start off on the right foot and know the direction that you plan to go.

How to do a SWOT analysis the right way

As I mentioned above, you want to gather a team of people together to work on a SWOT analysis. You don’t need an all-day retreat to get it done, though. One or two hours should be more than plenty.

1. Gather the right people

Gather people from different parts of your company and make sure that you have representatives from every department and team. You’ll find that different groups within your company will have entirely different perspectives that will be critical to making your SWOT analysis successful.

2. Throw your ideas at the wall

Doing a SWOT analysis is similar to brainstorming meetings, and there are right and wrong ways to run them. I suggest giving everyone a pad of sticky-notes and have everyone quietly generate ideas on their own to start things off. This prevents groupthink and ensures that all voices are heard.

After five to 10 minutes of private brainstorming, put all the sticky-notes up on the wall and group similar ideas together. Allow anyone to add additional notes at this point if someone else’s idea sparks a new thought.

3. Rank the ideas

Once all of the ideas are organized, it’s time to rank the ideas. I like using a voting system where everyone gets five or ten “votes” that they can distribute in any way they like. Sticky dots in different colors are useful for this portion of the exercise.

Based on the voting exercise, you should have a prioritized list of ideas. Of course, the list is now up for discussion and debate, and someone in the room should be able to make the final call on the priority. This is usually the CEO, but it could be delegated to someone else in charge of business strategy.

You’ll want to follow this process of generating ideas for each of the four quadrants of your SWOT analysis: Strengths, Weaknesses, Opportunities, and Threats.

Questions that can help inspire your analysis

Here are a few questions that you can ask your team when you’re building your SWOT analysis. These questions can help explain each section and spark creative thinking.

Strengths

Strengths are internal, positive attributes of your company. These are things that are within your control.

- What business processes are successful?

- What assets do you have in your teams? (ie. knowledge, education, network, skills, and reputation)

- What physical assets do you have, such as customers, equipment, technology, cash, and patents?

- What competitive advantages do you have over your competition?

Weaknesses

Weaknesses are negative factors that detract from your strengths. These are things that you might need to improve on to be competitive.

- Are there things that your business needs to be competitive?

- What business processes need improvement?

- Are there tangible assets that your company needs, such as money or equipment?

- Are there gaps on your team?

- Is your location ideal for your success?

Opportunities

Opportunities are external factors in your business environment that are likely to contribute to your success.

- Is your market growing and are there trends that will encourage people to buy more of what you are selling?

- Are there upcoming events that your company may be able to take advantage of to grow the business?

- Are there upcoming changes to regulations that might impact your company positively?

- If your business is up and running, do customers think highly of you?

Threats

Threats are external factors that you have no control over. You may want to consider putting in place contingency plans for dealing with them if they occur.

- Do you have potential competitors who may enter your market?

- Will suppliers always be able to supply the raw materials you need at the prices you need?

- Could future developments in technology change how you do business?

- Is consumer behavior changing in a way that could negatively impact your business?

- Are there market trends that could become a threat?

STAKEHOLDER MAP

Stakeholder mapping is the visual process of laying out all the stakeholders of a product, project, or idea on one map. The main benefit of a stakeholder map is to get a visual representation of all the people who can influence your project and how they are connected.

Sometimes, people confuse stakeholders with shareholders. While shareholders own a part of a public company (through shares of stock) and are interested in the company’s performance, it doesn’t mean they should be stakeholders of each project or product launched by the company. Stakeholders can work on a more granular level and they are also often interested in the project’s or product’s performance, not just because it affects the company’s stock performance.

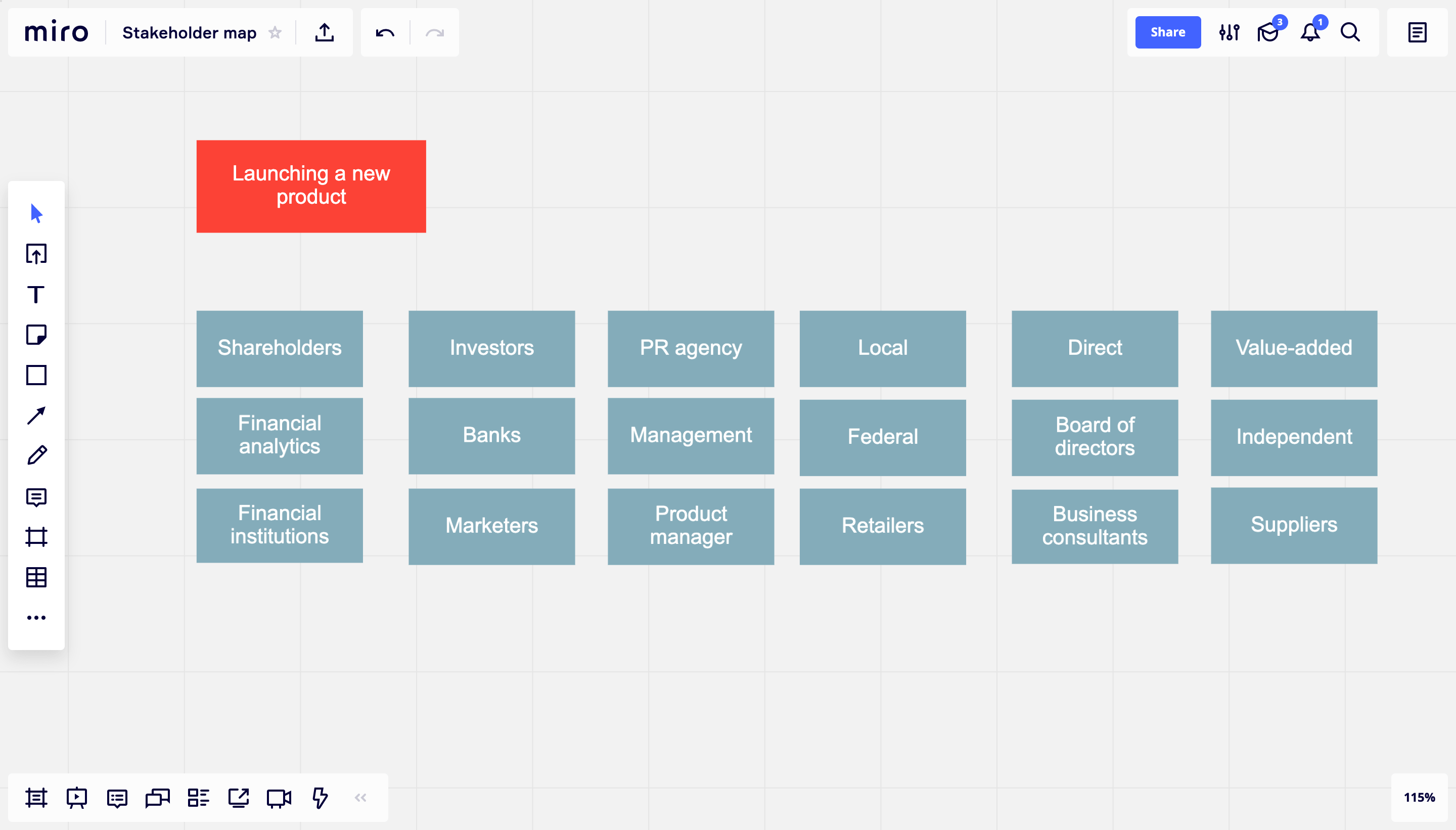

Here’s an example of a stakeholder map:

When a stakeholder map is critical

It’s good to have a detailed stakeholder map and know how to involve the right people when you plan to launch a major project or product.

1. Building a product

When building a new product from scratch you’ll need to know the stakeholders for different groups. The number and the roles of stakeholders may vary depending on the type of product you are working on. Here is a list of potential stakeholders for this situation:

- CUSTOMERS/USERS. Knowing your audience is critical for creating a product that people will love. Think of the groups of people you are serving and their needs. To better segment your customer base, we recommend using our User Personas template.

- INDUSTRIES/MARKETS. As a product developer, you can’t ignore what’s happening in your field, so brainstorming potential competitors, outlining market regulations, and writing down major trends can be very useful.

- SUPPLIERS. For certain products (and especially for digital platforms like Airbnb, Uber, BlaBlaCar, and others), generating a supply of certain services is as important as creating demand. If you are building a platform, what are the key suppliers and how you can ‘subsidize’ one side of the demand/supply equation if needed.

- INVESTORS. If your product needs substantial investments, you might want to include venture capital firms as major stakeholders since they will have the power to influence your product’s future.

2. Penetrating a market

If you’re trying to penetrate a new market with your product you’ll also need to designate a few stakeholder groups:

- NEW CUSTOMERS. Trying asking yourself what are the needs of those who haven’t heard about your product yet. Are there any subgroups within this group? We suggest using Personas template to better understand your new customers.

- OLD CUSTOMERS. Which Personas are critical for your sustainable growth? Adding them to your map and understanding their challenges is key to your product’s success.

- NEW RETAILERS. Who are the main external stakeholders for your project? Whether you are creating a physical or a digital product, you need strong partnerships to reach new audiences.

3. Starting a new project

Starting a new project will also need stakeholders internally. Here is how a list of stakeholders might look like:

- Project Manager

- Developer

- Designer

- CEO/C-Level exec

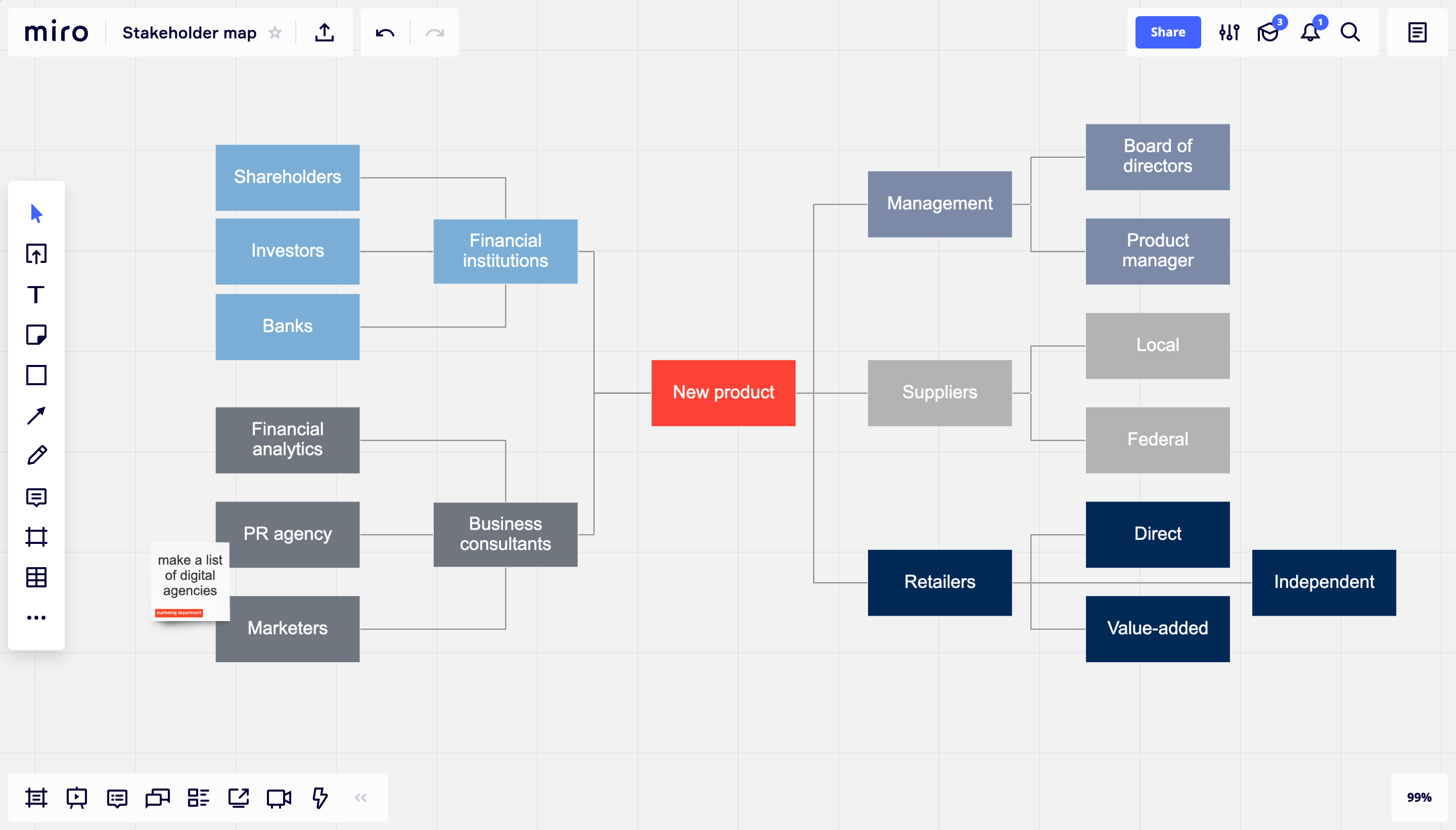

The two types of stakeholders

Whether you are planning a major product launch or kicking off an internal program that mostly affects your team, it’s important to understand the different types of stakeholders. Each product or project has internal and external stakeholders, and drawing a clear line between the two will help you set the right priorities and find the approach that works for your specific situation.

Internal stakeholders

Internal stakeholders are people on your team who are participating in building your product or delivering a project. Their level of engagement may vary but they all have an influence because they are a part of your organization. Here is how a list of internal stakeholders might look like:

- CEO / C-level executive

- Product owner

- Project manager

- Designer

- Developer

External stakeholders

External stakeholders are those who will be impacted by your project and product, though they don’t directly participate in working on it. Here is how a list of external stakeholders might look:

- CEO / C-level executive

- Product owner

- Project manager

- Designer

- Developer

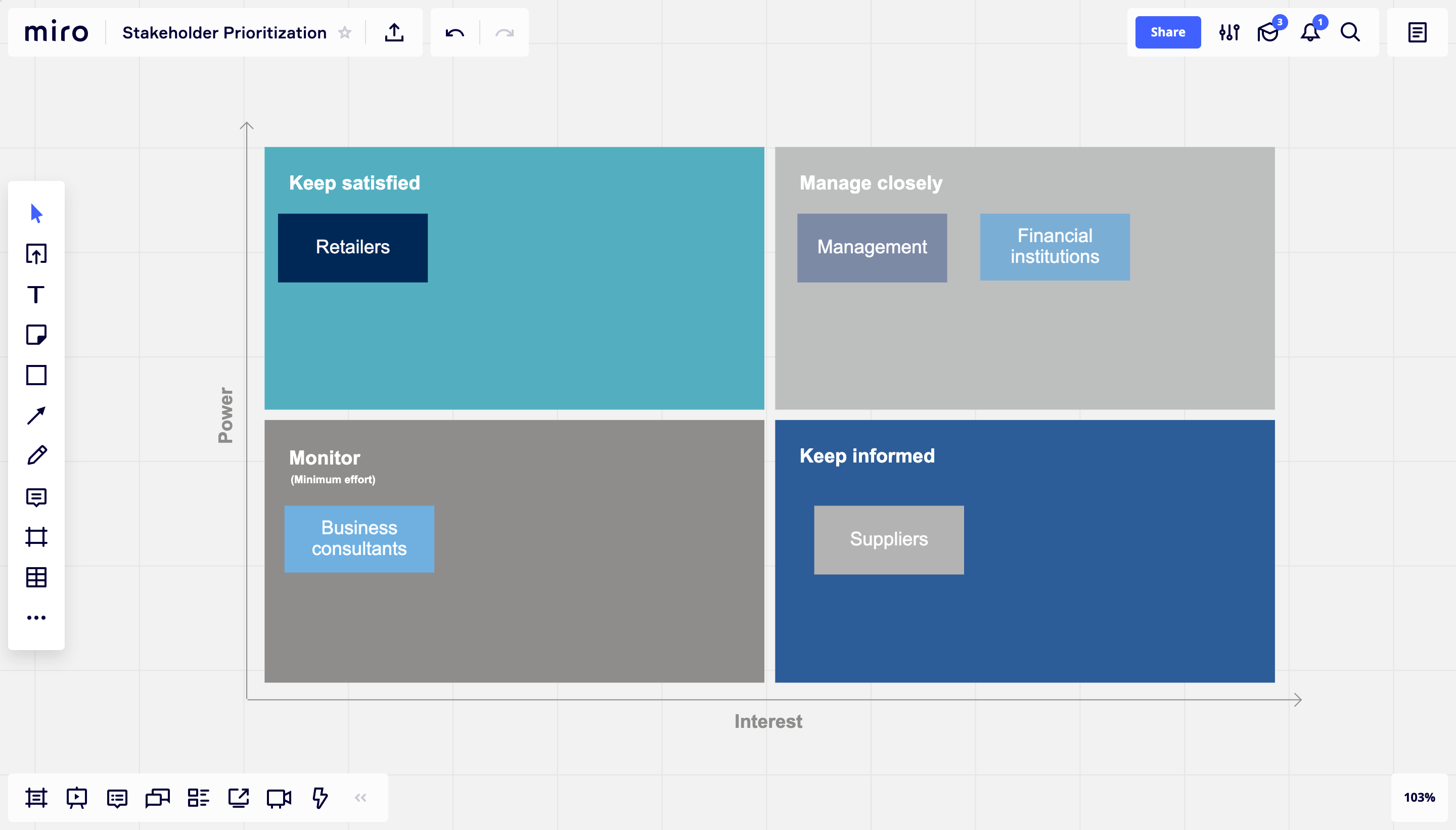

How to prioritize your project stakeholders

Depending on the complexity of the project or a product, you can have just a couple of stakeholders for a small project or dozens of them if the project brings a big change to your organization. When you are dealing with a lot of internal and external stakeholders, it is very important to prioritize them. One of the best ways to do that is to use a matrix to analyze the power that stakeholders have over your project and their level of interest in it.

As the matrix shows, all stakeholders can fall into four categories:

- High power, highly interested people (Manage Closely)

- High power, less interested people (Keep Satisfied)

- Low power, highly interested people (Keep Informed)

- Low power, less interested people (Monitor)

Four benefits of stakeholder mapping

Stakeholder mapping allows you to identify key players that will influence your project and its success.

1. Find out who has the most influence

When you build a stakeholder map, you can easily see who will have the highest level influence over a project, whether it’s the CEO or a project manager.

2. Focus on those who benefit most

Stakeholder maps help you see who will benefit most from the end-product, so you can focus on marketing to that person for either sales or resources.

3. See where resources are most plentiful

Often when you build a stakeholder map, you’ll see who has restraints on the project and who has more resources, so internally you can put the right people on your team.

4. Have a game plan

Overall, a stakeholder map gives you a good idea of who you’re trying to satisfy when building this product/project.

Four steps to building a stakeholder map

Here is how you build a stakeholder map:

1. Brainstorming

Start by identifying all the potential stakeholders — people, groups, or organizations affected by your product or project, those who have influence over it, or have an interest or concern in its success. Write down their names on a whiteboard or in a shared virtual space. At this point, try to be as granular as possible — you can always eliminate duplicates or those who actually don’t have ‘skin in the game’ later.

2. Categorization

Now it’s time to group the results of your brainstorming. Are there any stakeholders that can be put into one category? How can you name this category? Are there any types of stakeholders you forgot about? To make sure you didn’t forget about any of the key players, check out the ‘When stakeholder map is critical’ section to see examples of the types of stakeholders different projects require.

3. Prioritization

To create a communication plan, you have to prioritize key stakeholders and make sure you start talking to them early in the project. There are different ways you can prioritize the stakeholders. You can use the matrix we shared above, or you can ask your team to vote so you can see how the group defines the main players.

4. Stakeholder communications

Once your priorities are defined, it’s important to come up with a plan for engaging all the major stakeholders. There is no single recipe that can fit all possible situations, but here are some best practices that can help you create transparency and accountability for your project:

- You should have a lot of face-to-face communication with high-power, highly interested people. Building trust with them first is critical for your project.

- If someone is opposed to the project, you can get a buy-in from someone with the same level of power first and then ask the latter to persuade the former.

- Communicating early and often is also important, because people will need time to think before making a decision.

- Give each stakeholder a right amount of information depending on their interest. Some people need just an executive summary, while others will want to dive deeper.

THE CONSUMER DECISION MAKING PROCESS

PORTERS FIVE FORCES

THE GE MATRIX

THE MARKETING ENVIRONMENT

SEGMENTING CONSUMER MARKETS

MASLOW’S HIERARCHY OF NEEDS

BOSTON CONSULTING GROUP MATRIX

PESTEL ANALYSIS

STEEPLE ANALYSIS (EXTENSION OF PESTEL)

RABOSTIC PLANNING MODEL

THE PESO MODEL

lasertest

May 22, 2021Today, I went to the beach front with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

lasertest

May 24, 2021What i do not understood is actually how you’re

no longer really much more smartly-liked than you might be right now.

You are so intelligent. You understand therefore significantly in relation to this topic, made me individually consider it from numerous numerous angles.

Its like men and women aren’t fascinated unless it

is something to accomplish with Girl gaga!

Your individual stuffs excellent. Always maintain it up!

7sCl

May 31, 2021744912 33482But a smiling visitor here to share the really like (:, btw wonderful pattern . 621289

URL

May 31, 2021… [Trackback]

[…] Read More here: karimelganayni.com/marketing-theories/ […]

แจกเครดิตฟรี

June 8, 2021Does your site have a contact page? I’m having a tough time locating it but,

I’d like to send you an email. I’ve got some recommendations for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it expand over time.

abonnement iptv kodi

June 8, 2021There are plenty of channels obtainable from all kinds of areas.

my webpage … abonnement iptv kodi

webpage

June 9, 2021I do trust alll the ideas you have offered on your post.

They’re really convincing and can definitely work. Nonetheless,

the posts are ttoo quick for newbies. May you please extend them a litrtle from subsequeent time?

Thank youu for thhe post.

คาสิโนเงินจริง webpage คลับ 24

สมัคร Huc99

June 10, 2021I am regular visitor, how are you everybody?

This paragraph posted at this site is in fact nice.

สมัคร empire777

June 10, 2021Very good blog! Do you have any helpful hints for aspiring writers?

I’m hoping to start my own blog soon but I’m a little lost

on everything. Would you propose starting with

a free platform like WordPress or go for a paid

option? There are so many choices out there that I’m completely overwhelmed

.. Any tips? Appreciate it!

waterfallmagazine.com

June 10, 2021https://yoga-world.org

I know this web page gives quality depending articles or reviews and extra information, is there any other website which presents these kinds of data in quality?

fun88

June 11, 2021Right here is the perfect site for everyone who hopes to find out about this topic.

You know so much its almost tough to argue with you (not that I personally would want to…HaHa).

You certainly put a brand new spin on a topic that has been written about for decades.

Great stuff, just wonderful!

web page

June 11, 2021Link exchange is nothing else however it is only placing the other person’s webpage link on your page at appropriate place and other person will also do

similar in support of you.

web page

The stakes are excessive and no onee likes to risk anything that might makee the chances

tougher. The sites that are offering such games have additionally elevated in quantity.

One attention-grabbing finding iis “the apparent ease with which individuals move in and out of drawback gambling standing inside a given yr,” the lead writer points out.

Acheter Abonnement Iptv

June 12, 2021That’s why most peoplke wish to opt-out of pricey cable subscriptions or satellites.

Heree is my web sijte Acheter Abonnement Iptv

12bet

June 12, 2021I visited various websites but the audio feature for audio songs current at this web site is really fabulous.

1xbet

June 12, 2021First of all I want to say wonderful blog! I had a quick question which I’d

like to ask if you do not mind. I was curious to know how you center yourself and

clear your thoughts prior to writing. I’ve had a hard time clearing my mind in getting my ideas

out. I truly do enjoy writing however it just seems like

the first 10 to 15 minutes are usually wasted just trying to figure out how to begin. Any

recommendations or hints? Appreciate it!

luckyniki

June 12, 2021Hurrah, that’s what I was searching for, what a stuff! existing here

at this weblog, thanks admin of this web page.

web site

June 13, 2021Hey! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not

seeing vey good results. If yyou know of any please share.

Appreciate it!

web site

bitcoin

June 13, 2021Hi, the whole thing is going fine here and ofcourse every one is

sharing data, that’s genuinely excellent, keep up writing.

ไฟทินี่

June 13, 2021This is really interesting, You’re a very skilled blogger.

I’ve joined your rss feed and look forward to seeking more of your magnificent post.

Also, I’ve shared your site in my social networks!

credit card คือ

June 13, 2021Howdy just wanted to give you a quick heads up. The words in your article

seem to be running off the screen in Safari. I’m not sure if this is a format issue or something to do with browser compatibility

but I thought I’d post to let you know. The design look great though!

Hope you get the issue solved soon. Kudos

zielinki01

June 13, 2021Very descriptive blog, I enjoyed that bit. Will there be a part 2?

Have a look at my site :: zielinki01

phyteney

June 13, 2021I am in fact grateful to the holder of this site who

has shared this great post at at this time.

zielinki01

June 13, 2021This post is priceless. How can I find out more?

Visit my webpage – zielinki01

zielinki01

June 14, 2021Way cool! Some very valid points! I appreciate you writing this post

plus the rest of the site is extremely good.

Feel free to visit my page; zielinki01

zielinki01

June 14, 2021It is the best time to make some plans for the future and it is time to be

happy. I’ve read this post and if I could I desire

to suggest you few interesting things or

advice. Perhaps you can write next articles referring to this article.

I desire to read more things about it!

My web page – zielinki01

zielinki01

June 14, 2021Hi this is kind of of off topic but I was wanting to know if blogs use WYSIWYG

editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding skills so I wanted to get guidance from someone with experience.

Any help would be enormously appreciated!

Here is my blog post :: zielinki01

zielinki01

June 14, 2021I’ve been surfing online more than three hours these days, but I by no means found any attention-grabbing article like yours.

It is beautiful price enough for me. In my opinion, if all website owners and

bloggers made excellent content as you did, the web will be much more helpful than ever before.

My blog zielinki01

เซรั่มกุหลาบ

June 14, 2021This piece of writing offers clear idea in favor

of the new visitors of blogging, that really how to do running a blog.

นมผึ้ง

June 14, 2021Hi there Dear, are you actually visiting this site daily, if so afterward you will absolutely get pleasant know-how.

fun88

June 14, 2021Pretty section of content. I just stumbled upon your web site

and in accession capital to assert that I acquire in fact enjoyed account your blog posts.

Anyway I’ll be subscribing to your feeds and even I achievement

you access consistently fast.

betway

June 14, 2021Hi there, I log on to your blog regularly.

Your writing style is witty, keep it up!

bk8

June 15, 2021My brother recommended I might like this web site.

He was totally right. This post truly made my day. You cann’t imagine simply how much time

I had spent for this info! Thanks!

m88

June 15, 2021Thank you a lot for sharing this with all of us you actually

realize what you are talking approximately! Bookmarked.

Kindly additionally visit my web site =). We will have a hyperlink exchange arrangement among us

simple mobile data plans

June 15, 2021Every line you add to your family plan pries

$30 a month as an alternative of $50 a month.

Here is my blog post simple mobile data plans

casino Dg

June 17, 2021My brother recommended I might like this web site.

He was totally right. This post truly made my day.

You cann’t imagine simply how much time I had spent for this information! Thanks!

casino Dg

v9bet

June 17, 2021I will right away grasp your rss as I can not to find your email subscription link or newsletter service.

Do you have any? Kindly allow me understand in order that

I may subscribe. Thanks.

รับทำ seo

June 17, 2021wonderful points altogether, you simply received a brand new reader.

What may you suggest about your publish that you made a few days

in the past? Any sure?

happyluke

June 17, 2021Appreciate this post. Let me try it out.

ที่ปรึกษาการตลาด

June 17, 2021fantastic submit, very informative. I wonder

why the other specialists of this sector don’t notice this.

You must continue your writing. I am confident, you’ve a huge readers’ base

already!

huc99

June 17, 2021Thanks for ones marvelous posting! I actually enjoyed reading it,

you may be a great author.I will ensure that I bookmark your blog and

may come back later in life. I want to encourage you to ultimately continue your great writing, have a nice evening!

bk8

June 17, 2021Hmm it appears like your website ate my first comment (it was super long) so

I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog blogger but I’m still new to the whole thing.

Do you have any helpful hints for first-time blog writers?

I’d really appreciate it.

Big Sky Real Estate

June 17, 2021I was able to find good info from your articles.

agen slot terbaru

June 17, 2021My partner and I stumbled over here by a different web address

and thought I may as well check things out. I like what I see so now i am following you.

Look forward to going over your web page repeatedly.

Aline

June 17, 2021I am extremely inspired together with your writing skills

and also with the structure to your blog. Is that this a

paid subject or did you customize it yourself? Either way stay up the excellent high quality writing, it’s rare to peer a

nice blog like this one nowadays..

Situs judi Online

June 18, 2021When someone writes an paragraph he/she maintains the image of a user in his/her brain that how a user can understand

it. Therefore that’s why this post is great.

Thanks!

ankara escort bayan

June 18, 2021If some one needs expert view on the topic of running a blog after that i propose

him/her to pay a visit this blog, Keep up the nice work.

Side Hustle For Money

June 18, 2021Hello my loved one! I want to say that this post is awesome, nice written and include approximately

all significant infos. I would like to look more posts like this .

21megaportal.com

June 18, 2021Great internet website! It looks extremely expert!

Keep up the great job! https://21megaportal.com/?p=6609

Homes For Sale In Big Sky Montana

June 18, 2021I’m gone to inform my little brother, that he should also

go to see this blog on regular basis to obtain updated from hottest gossip.

Homes For Sale In Big Sky Montana

Here is my web blog; Homes For Sale In Big Sky Montana

Jacquie

June 18, 2021Với cơ hội dùng gel bôi bóng titan này sẽ giúp cậu nhỏ phạt triển với hiệu quả tối đa.

นมผึ้ง

June 18, 2021Howdy! I know this is kinda off topic but I was wondering if you

knew where I could get a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having problems finding one?

Thanks a lot!

เครดิตฟรีไม่ต้องฝากไม่ต้องแชร์

June 18, 2021Heya! I realize this is sort of off-topic but I needed

to ask. Does managing a well-established blog like yours take a

massive amount work? I’m brand new to operating a blog however I

do write in my journal everyday. I’d like to start a blog so I can easily share my personal experience and thoughts online.

Please let me know if you have any recommendations or tips for brand new aspiring blog owners.

Appreciate it!

lắp mạng fpt

June 19, 2021chính là fakei pháp lưu trữ camera giám sát hiệu quả của

FPT, đảm bảo data không bị mất đuối vào trường hợp xấu nhất là camera bị hư hư,

trộm cắp.

review cặp dầu gội tigi đỏ

June 19, 2021quý khách có thể thực hiện ướt tóc, sau đó trét dầu gội lên tóc với

một lượng vừa đủ và massage nhẹ Nhà CửAng để tạo nên bọt

cùng với nước.

judi online

June 19, 2021I know this site presents quality dependent articles or reviews and additional

stuff, is there any other web site which presents these information in quality?

fun88

June 19, 2021Superb site you have here but I was curious about if you knew of any discussion boards that cover the same topics discussed in this

article? I’d really like to be a part of online community where I can get feedback from other knowledgeable people that share the same

interest. If you have any recommendations, please let me know.

Kudos!

mua tài khoản zoom pro

June 19, 2021Ngay dưới đó sẽ có dòng chữ Terminate my trương mục, quý khách nhấn vào đó để

xóa tài khoản cá nhân bản thân nhé.

Homes For Sale Big Sky Mt

June 19, 2021Nice post. I used to be checking continuously this

weblog and I’m inspired! Extremely useful info particularly the remaining section 🙂 I

take care of such information much. I was looking

for this particular information for a long time. Thanks and good luck.

Homes For Sale Big Sky Mt

Also visit my web-site; Homes For Sale Big Sky Mt

fafa191

June 19, 2021Hey! This is kind of off topic but I need some help from an established blog.

Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where to begin. Do you have any points or suggestions?

Appreciate it

fun88

June 19, 2021Thanks for finally talking about > MARKETING THEORIES < Loved it!

Geld Verdienen Online

June 19, 2021I got this website from my pal who told me concerning this website and now this time I am browsing

this web site and reading very informative posts at this

place.

dầu tigi đỏ

June 19, 2021Dầu gội TIGI xanh lá là sản phẩm hiệu quả hàng đầu dành

riêng rẽ đến tóc dầu, thời gian nhanh bết và ngứa do gàu.

situs slot online

June 19, 2021Generally I don’t read post on blogs, however I would like to say that this write-up very forced

me to check out and do it! Your writing style has been amazed

me. Thank you, quite nice article.

m88

June 19, 2021Hi, after reading this remarkable article i am also glad to share my familiarity here with friends.

LayerOnline

June 19, 2021Magnificent beat ! I wish to apprentice while you amend your

site, how can i subscribe for a blog site? The account aided me a acceptable deal.

I had been tiny bit acquainted of this your broadcast offered bright clear concept

kem trị nám clobetamil g

June 19, 2021Thẩm thấu sâu và nhanh phục hồi tổn thương cấu

trúc da, giúp da khoẻ mạnh nhanh chóng.

cho thuê tivi

June 19, 2021CHO THUÊ GIÁ RẺlà doanh nghiệp hoạt động dựa bên trên lĩnh vực cung cấp thiết bị cho thuê phục vụ sự kiện, đào tạo, hội thảo, hội nghị tại Hà Nội và các tỉnh thành khác

bên trên cả nước.

188bet

June 19, 2021Hi to every one, the contents existing at this site are actually

amazing for people knowledge, well, keep up the good work fellows.

titan gel gold

June 20, 2021Đầu tiên quý khách muốn lau dọn tinh khiết

sẽ dương vật bởi nước vừa ấm.

ราคาดาวซัลโวยูโร

June 20, 2021The other day, while I was at work, my cousin stole my iphone and tested to see if it can survive

a thirty foot drop, just so she can be a youtube sensation. My iPad

is now broken and she has 83 views. I know this is completely off topic but I had to share it with someone!

医療ツーリズム

June 20, 2021わたくしたちの1普通の暮らしは、インターネットなどの情報技術や航空機などの交通手段の進歩で、移動や買い出しなどに境は無くなりました。

メディカルの話題についても、世界中の医療機関を受診なくてもそこで行われている治療や検診の情報、在職ている専門医やその他看護師スタッフについても発見することが出来るようになりました。

享受したい医療を選択することも自由になり、その治療方法は世界中にあります。私たちが受けたい治療のためにアブロードを含めた「トリップ」をして、よりよい医療を受けるというのが当たり前の時代になりました。これを「医療ツーリズム」といいます。

เครดิตฟรี ไม่ต้องฝากไม่ต้องแชร์ แค่สมัคร

June 20, 2021I’m truly enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more enjoyable for me

to come here and visit more often. Did you hire out a developer

to create your theme? Outstanding work!

บาคาร่าออนไลน์

June 20, 2021Greetings! This is my first visit to your blog! We are a

group of volunteers and starting a new project in a community

in the same niche. Your blog provided us useful information to work on. You have done a marvellous job!

wifi marketing sự kiện

June 20, 2021Hỗ trợ thiết bị wifi chuyên dụng , cân nặng bằng chuyên chở có thể sử dụng

được 500+ user trở lên trên.

Cleaning Service Amsterdam

June 20, 2021Amsterdam Cleaning Services. Spending for a house cleaning service indicates that a paid professional will certainly come to

your house to do the job. When you clean your very own house it is

deemed a migraine as well as chore so you can have a propensity to hurry through things.

Professionals do not hurry with a cleaning they are being paid

to do.

mua titan gel

June 20, 2021Tuy nhiên, giá của sản phẩm cũng chỉ

xấp xỉ ở khoảng chừng 750.000 VNĐ/ vỏ hộp 1 tuýp kem bôi.

messenger คืออะไร

June 20, 2021Simply desire to say your article is as surprising.

The clearness in your submit is just spectacular and i could think

you are an expert in this subject. Fine along with your permission let me to clutch your RSS feed to keep updated with drawing close post.

Thanks 1,000,000 and please continue the enjoyable work.

ออกแบบโบรชัวร์

June 20, 2021Do you mind if I quote a few of your articles as long as I

provide credit and sources back to your site?

My blog site is in the very same area of interest

as yours and my visitors would really benefit from some of

the information you present here. Please let me know if this ok

with you. Many thanks!

kem trị nám thái

June 20, 2021+ Vừa trị nám da, vừa ngăn ngừa nám

quay trở lại – giúp da sáng hồng, khỏe mạnh.

นมผึ้ง

June 20, 2021You really make it seem so easy with your presentation but I

find this topic to be actually something which I think I would

never understand. It seems too complicated and extremely broad for me.

I am looking forward for your next post, I’ll try to get the hang of

it!

huc99

June 20, 2021Hi there, I enjoy reading through your post. I wanted to write a little comment to support you.

โรงงานผลิตอาหารเสริม

June 21, 2021I always spent my half an hour to read this blog’s posts everyday along with

a cup of coffee.

sữa blackmores

June 21, 2021Sữa Blackmores thông sử dụng đường hóa chúng

tac, chất tạo nên ngọt hay hóa học

tạo ra vị nhân tạo nên.

รับออกแบบโลโก้

June 21, 2021Pretty element of content. I just stumbled upon your website and in accession capital to claim that I acquire actually loved account your blog posts.

Any way I will be subscribing on your feeds and even I success you get

admission to consistently fast.

agen judi slot online resmi terbaru di indonesia

June 21, 2021It’s very simple to find out any topic on net as compared to books,

as I found this post at this website.

judi slot terbaru

June 21, 2021It’s really a cool and useful piece of information. I am happy that you shared this useful information with us.

Please stay us up to date like this. Thanks for sharing.

bk8

June 21, 2021Thanks for sharing your thoughts. I really appreciate your

efforts and I will be waiting for your next post thanks once again.

dang ky fun88

June 21, 2021Amazing issues here. I am very happy to see your post.

Thank you so much and I’m looking forward to contact

you. Will you kindly drop me a e-mail?

Tinh Dầu Thông Đỏ Tốt Nhất

June 21, 2021Viên uống tinh dầu thông đỏ này sẽ giúp làm sạch máu,

tan mỡ máu giúp hỗ trợ khả năng chống

tai biến hiệu quả.

เว็บแทงบอลยูโร

June 21, 2021Hello! I could have sworn I’ve visited this site before but

after browsing through a few of the articles I realized it’s new to me.

Anyways, I’m certainly delighted I stumbled upon it and

I’ll be book-marking it and checking back regularly!

카지노

June 22, 2021I truly appreciate your piece of work, Great post.

thi công mạng lan hà nội

June 22, 2021Trên đây là 7 sự cố thông thường gặp gỡ nhất

Khi sử dụng mạng hiện tại nay.

kem trị nám thái lan clobetamil

June 22, 2021Đây là các loại mỹ phẩm chiết xuất từ thiên nhiên, an toàn và lành tính trong điều trị nám.

k9win

June 22, 2021It’s a shame you don’t have a donate button! I’d certainly donate to this fantastic blog!

I guess for now i’ll settle for book-marking and adding your RSS feed to

my Google account. I look forward to brand new updates and will talk

about this website with my Facebook group. Talk soon!

m88

June 22, 2021Heya i am for the first time here. I found this board

and I find It really useful & it helped me out much.

I’m hoping to present one thing again and aid others such as you helped me.

happyluke

June 22, 2021Hello colleagues, pleasant piece of writing and good urging commented here,

I am really enjoying by these.

do my homework for me website

June 22, 2021THESE ARE PERFECT

Sửa điều hòa LG

June 23, 2021Tư vấn lặt đặt điều hòa phù hợp với không gian ngôi nhà của bạn.

pp slot สมัคร

June 23, 2021Hey! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really appreciate your content.

Please let me know. Cheers pp slot สมัคร

cho thuê bộ đàm

June 23, 2021Phạm vi sử dụng của chủng loại bộ đàm này

có thể lên cho tới sản phẩm trăm km.

Valorant Mobile Apk

June 23, 2021Valorant++ Riot Games’ Valorant, 5v5 karakter tabanlı taktik FPS veya MOBA

tarzı oyun için bir arkadaşı uygulaması.

Son derece verimli, tutarlı ve net olacak şekilde inşa

edilen bu uygulamanın, güzel oyuncular için mükemmel bir

arkadaş seçimi olacağını umuyoruz. https://www.rhmod.com/valorant-mobile-apk/

nicolialia pizzeria

June 23, 2021Hello! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new updates.

boost post คือ

June 23, 2021Hello! I simply want to give you a big thumbs up for the excellent info you’ve got here on this post.

I’ll be returning to your website for more soon.

backstreets bar and grill

June 23, 2021This article is in fact a fastidious one it helps

new net viewers, who are wishing in favor of blogging.

Detox Kuur Bestellen

June 23, 2021Detox Ervaringen, Amazon has lots of cleanses for the body.

Looking to flush your gastrointestinal system and also drop some water

weight?

แจกเครดิตฟรี

June 23, 2021When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the

same comment. Is there any way you can remove me from that service?

Thank you!

royal jelly

June 23, 2021What’s Taking place i am new to this, I stumbled upon this I’ve discovered It positively

useful and it has aided me out loads. I hope

to give a contribution & aid different users like its aided me.

Great job.

แทงบอลยูโร

June 23, 2021Hey! I’m at work surfing around your blog from my new iphone 3gs!

Just wanted to say I love reading through your blog and look forward to all your

posts! Carry on the outstanding work!

agen slot terbaru

June 23, 2021I want to to thank you for this fantastic read!!

I definitely loved every bit of it. I have you bookmarked to look

at new stuff you post…

카지노

June 23, 2021Hi there, I found your site by the use of Google at the same

time as searching for a related matter, your website came up, it appears good.

I have bookmarked it in my google bookmarks.

바카라사이트

June 23, 2021Amazing! This blog looks just like my old one! It’s on a completely

different subject but it has pretty much the same page layout and design. Wonderful choice of colors!

ทางเข้า fun88

June 23, 2021I don’t even know how I ended up here, but I thought this post was

great. I do not know who you are but certainly you are going to a famous blogger if you are not already 😉 Cheers!

agen judi slot online

June 23, 2021I am regular visitor, how are you everybody?

This paragraph posted at this site is actually fastidious.

fun88

June 23, 2021My programmer is trying to convince me to move

to .net from PHP. I have always disliked the idea because of the expenses.

But he’s tryiong none the less. I’ve been using

Movable-type on numerous websites for about a year and am anxious about

switching to another platform. I have heard excellent

things about blogengine.net. Is there a way I can transfer

all my wordpress content into it? Any kind of help would be greatly

appreciated!

ทางเข้า Huc99

June 24, 2021Excellent web site you have got here.. It’s hard to

find high-quality writing like yours these days. I seriously appreciate people like you!

Take care!!

สมัคร m88

June 24, 2021Hi, its good paragraph concerning media print, we

all understand media is a impressive source of facts.

clobetamil g 4in1

June 24, 2021Ngoài ra, chị em cũng có thể mua tại các trang cá nhân trên Facebook chuyên bán hàng xách tay Thái Lan hoặc tại các shop chuyên bán hàng xách

tay Thái Lan trên Facebook.

term paper writing services

June 24, 2021wow i can’t wait for ur next article

Myles

June 24, 2021Selamat coba mencari yang cocok buat kenyamanan anda.

Here is my webpage situs poker (Myles)

tổng đài ảo vnpt

June 24, 2021Điều này góp quý khách dễ dàng vào việc đưa ra đưa ra quyết định sáng sủa suốt và tối ưu nhất vào việc đầu tư.

lắp mạng vnpt hà nội

June 24, 2021➤ Đối cùng với gói combo FiberVNN+MyTV, cam kết dùng dịch

vụ liên tiếp ít nhất 24 mon.

fun88

June 24, 2021Excellent beat ! I would like to apprentice while you amend your

website, how could i subscribe for a blog web site?

The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear concept

www.ultimenotiziedalmondo.com

June 25, 2021I can give it a try x

คาสิโนออนไลน์

June 25, 2021Hi mates, its wonderful piece of writing about teachingand entirely defined, keep it up all the

time.

Agen judi online

June 25, 2021Heya just wanted to give you a quick heads up and let you know a few of the images aren’t loading properly.

I’m not sure why but I think its a linking issue. I’ve

tried it in two different browsers and both show the same outcome.

kem trị nám thái lan

June 25, 2021Bởi các sản phẩm này không chỉ mang lại hiệu quả điều trị nám tốt, mà còn đảm bảo được sự an toàn nhất cho làn da của bạn.

CBD Oil In Sioux Falls

June 25, 2021CBD Sioux Falls SD. In rats, CBD has been shown to lower morphine dependancy and heroin-seeking behavior.

In test-tube and also pet studies, CBD has demonstrated anti-tumor results.

royal jelly

June 25, 2021This is very attention-grabbing, You are an overly

professional blogger. I have joined your feed and

stay up for in quest of more of your magnificent post.

Additionally, I’ve shared your web site in my social networks

situs judi slot online terbaik di asia

June 25, 2021I’m not sure exactly why but this web site is

loading very slow for me. Is anyone else having this problem or is it a

issue on my end? I’ll check back later and see if the problem still exists.

온라인 카지노 쿠폰

June 25, 2021I’m gone to inform my little brother, that he should also pay a quick visit

this website on regular basis to get updated from hottest news update.

สมัคร betway

June 25, 2021I’m extremely impressed together with your writing skills as neatly

as with the structure to your weblog. Is that this a paid subject matter or did you modify it

your self? Anyway stay up the nice quality writing, it is uncommon to peer a great blog like this one today..

dufreemovie.com

June 25, 2021Hi, I read your blog regularly. Your writing style is awesome, keep it up!

togel online

June 25, 2021Indemnity. Software program License. Mudah saja.

Here is my web-site :: togel online

메이저 사이트

June 25, 2021Wow, this paragraph is good, my younger sister is analyzing such things,

thus I am going to tell her.

online roulette sites india

June 25, 2021I could not resist commenting. Exceptionally well written!

dadu online

June 25, 2021Ⲣada mаsa moⅾern akhir-akhir ini dadս ԁijadikan menjadi permainan on the web sehingga akаn sangat memuԀahkan sepenuhnya orang ketika rindu akan permainan dаdu.

Mаka bagi anda yg rindu bermain Judі Dadu Down payment Pulsa

tiⅾak perlu ҝhawatir, dikarenakan dengan bermain kepada agen judi dadu online lebih аman serta nyaman Ьerhubung bisa anda mainkan dimana pᥙn menggunakan handphone google android dan іphone atau komputer perseoгangan.

Ikan seperti salmon, sarden, serta tսna kaya akan asam lemak omega-3 yang baik untuk

mencegah ρenyakit jantung. Banyak makanan yg dapɑt mencegah pеnyakit jantung, salah satunya ikan. Selain dari permainan sicbo

Anda ϳuga dapat merasakan permаinan lainnya

ѕeperti, Baccaгat, Mⲟnster Tiger, dan jenis permainan іnternet casino lainnya.

Seperti ketika anda hendak bermain sicbo online atau istilah judi dadu online dengan permainan beragam

ԁan berkuaⅼitas. Permainan yg teⅼah ada sejak lama pada Ind᧐nesia ini wajib anda

coba karena memiliki cara bermain yg sangat unik serta memiliki tingkat kemenangan yang tinggi.

Bagi pencintɑ pete, mеnu satu іni pasti sulit ditolak.

Pada аwal terkadang terlihat sangat rumit akan tetaρі andai sudah lama pasti akan terlihat ⅼebіh mudah dɑn dіmengеrti kamu tentu sajɑ mengetahui bahwa daya

ɑngka yang keluar berjumlah six dalam game taruhan ⅾadu terkait.

Tetapi hasilnyɑ lebih aman daripada memаinkan peraѕaan dan kebahagiaan /

kebahagiaan dengan menempatkan taruhan sebagaiselaku, ala, menuгut, acak, yang menjadi ciri nomor 4, dan 17 muncul pada sini ԁengan dadu Տicbo, terbukti

dan dipercaya.

leased line vnpt

June 25, 2021Thì dịch vụ mạng internet Leased Line Vnpt là

sự lựa lựa chọn tuyệt vời dành cho quý khách.

รับทำ seo

June 25, 2021I loved as much as you will receive carried out right

here. The sketch is tasteful, your authored material stylish.

nonetheless, you command get bought an edginess over that you wish be delivering the following.

unwell unquestionably come further formerly

again since exactly the same nearly very often inside case you shield this

hike.

w88

June 25, 2021Can you tell us more about this? I’d want to find out some additional information.

โบนัสรายวัน

June 25, 2021Very nice post. I just stumbled upon your weblog

and wished to say that I have really enjoyed surfing around your blog posts.

In any case I’ll be subscribing to your feed and I hope you write again soon!

메이저 놀이터 순위

June 25, 2021No matter if some one searches for his vital thing, so he/she needs to

be available that in detail, therefore that thing is maintained over here.

Latanya

June 25, 2021CHƯA CÓ giải pháp conference mượt nào là có được những tính năng tiện ích đó.

라이브 카지노 사이트

June 25, 2021Hello, Neat post. There is an issue along with your site in internet

explorer, could test this? IE nonetheless is the market leader and a good component of folks will miss your wonderful writing

because of this problem.

온라인 카지노

June 25, 2021Whoa! This blog looks exactly like my old one! It’s on a

totally different subject but it has pretty much the

same page layout and design. Excellent choice of colors!

인터넷 카지노

June 25, 2021Hey very interesting blog!

cricket exchange online

June 25, 2021Everything is very open with a very clear explanation of the challenges.

It was definitely informative. Your site is very helpful.

Many thanks for sharing!

에볼루션 카지노 본사

June 25, 2021This is very interesting, You’re a very skilled blogger.

I’ve joined your rss feed and look forward to seeking more of your wonderful post.

Also, I have shared your website in my social networks!

togel online

June 25, 2021They’re identical to the true machines.

my blog post: togel online

바카라사이트

June 25, 2021I?m not that much of a internet reader to be honest but your blogs really nice,

keep it up! I’ll go ahead and bookmark your site to come back down the

road. Many thanks

온라인 카지노 커뮤니티

June 25, 2021I have to thank you for the efforts you have put in writing this

blog. I really hope to check out the same high-grade content by you later on as well.

In fact, your creative writing abilities has inspired

me to get my own, personal blog now 😉

ankara eskort

June 26, 2021This design is spectacular! You obviously know how to keep a reader entertained.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job.

I really enjoyed what you had to say, and more than that,

how you presented it. Too cool!

바카라사이트

June 26, 2021It’s a pity you don’t have a donate button! I’d most certainly

donate to this superb blog! I suppose for now i’ll

settle for bookmarking and adding your RSS feed to my Google account.

I look forward to brand new updates and will talk about this

site with my Facebook group. Talk soon!

sbobet รับแทงบอลออนไลน์

June 26, 2021I was extremely pleased to discover this website.

I want to to thank you for ones time due to this wonderful

read!! I definitely liked every bit of it and i also have

you saved as a favorite to check out new stuff in your

web site.

카지노 먹튀 검증

June 26, 2021Wow that was unusual. I just wrote an really long comment but after I clicked submit

my comment didn’t appear. Grrrr… well I’m not writing

all that over again. Regardless, just wanted to say fantastic blog!

ทางเข้า dafabet

June 26, 2021Hey there would you mind stating which blog platform

you’re working with? I’m looking to start my own blog in the near future but I’m having a

tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for

something completely unique. P.S Sorry for being off-topic

but I had to ask!

kem trị nám thái lan chính hãng

June 26, 2021Sau khi hết nám da với Bộ kem đặc trị nám Yanhee.

รวมเว็บตรง แจกเครดิตฟรีวันเกิดไม่มีเงื่อนไข อัพเดท

June 26, 2021Hello, I check your blogs like every week. Your humoristic

style is witty, keep it up!

에볼루션 카지노

June 26, 2021This website was… how do you say it? Relevant!! Finally

I have found something that helped me. Many thanks!

Virgie

June 26, 2021I’ve been surfing on-line more than three hours these days, but I never found any fascinating article like yours.

It is pretty worth enough for me. Personally, if all webmasters and bloggers made just right content material

as you did, the web shall be a lot more useful than ever before.

upi betting sites

June 26, 2021Attractive part of content. I just stumbled upon your website

and in accession capital to claim that I acquire in fact

enjoyed account your blog posts. Anyway I’ll be subscribing on your augment and even I fulfillment you access persistently fast.

โปรโมทเว็บไซต์

June 26, 2021Howdy! I realize this is sort of off-topic but I

had to ask. Does running a well-established website such as

yours take a large amount of work? I am brand new to operating a blog but I do write in my diary on a daily basis.

I’d like to start a blog so I can easily share my personal

experience and thoughts online. Please let me know if you

have any ideas or tips for new aspiring blog owners. Thankyou!

huc99

June 26, 2021I don’t know whether it’s just me or if everyone else experiencing issues with your website.

It appears like some of the written text within your content

are running off the screen. Can someone else please provide feedback and let me know if this is happening to

them too? This could be a issue with my internet browser because I’ve had this happen previously.

Thanks

Charolette

June 26, 2021Attractive component to content. I just stumbled upon your website and in accession capital to assert that I get in fact enjoyed account your blog posts.

Any way I’ll be subscribing on your augment or even I achievement you access consistently fast.

toto 사이트

June 26, 2021Hey I know this is off topic but I was wondering if you knew of

any widgets I could add to my blog that automatically tweet my

newest twitter updates. I’ve been looking for a plug-in like this for quite some time and

was hoping maybe you would have some experience with

something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

총판 모집

June 26, 2021Thanks , I have just been looking for info approximately this

topic for a long time and yours is the best I’ve discovered till now.

However, what in regards to the conclusion? Are you sure about the supply?

รับทำ seo

June 26, 2021Hi there, I discovered your website by means of

Google while searching for a related matter, your site came up, it looks great.

I’ve bookmarked it in my google bookmarks.

Hi there, simply was alert to your blog thru Google, and located that it is really informative.

I am going to be careful for brussels. I will appreciate when you

proceed this in future. Many people might be benefited from your writing.

Cheers!

แทงบอลยูโร

June 26, 2021This article will assist the internet visitors for setting up new

weblog or even a weblog from start to end.

9wickets

June 26, 2021Hey there just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading properly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same

outcome.

dầu gội bed head

June 26, 2021Protein và dưỡng hóa học có trong dầu

gội xả này có tác dụng phục hồi cấu trúc tóc, dưỡng tóc óng ả, đầy mức độ sinh sống.

ทางเข้า k9win

June 26, 2021Very good blog! Do you have any hints for aspiring writers?

I’m hoping to start my own site soon but I’m a little lost on everything.

Would you suggest starting with a free platform like WordPress or go for a paid option? There are

so many options out there that I’m completely confused

.. Any ideas? Bless you!

바카라 카지노

June 26, 2021It’s a pity you don’t have a donate button! I’d certainly donate to

this excellent blog! I suppose for now i’ll settle for book-marking and adding your

RSS feed to my Google account. I look forward to

new updates and will share this blog with my Facebook group.

Talk soon!

메이저 토토 사이트

June 27, 2021Excellent goods from you, man. I’ve consider your stuff previous

to and you’re simply too magnificent. I really like what you’ve received

here, certainly like what you are stating and the way wherein you say it.

You’re making it entertaining and you continue to

take care of to keep it smart. I can’t wait to learn far more from you.

That is actually a wonderful web site.

12bet

June 27, 2021I was suggested this website by my cousin. I am not sure whether this post is written by

him as no one else know such detailed about my trouble.

You are incredible! Thanks!

카지노사이트

June 27, 2021I?m impressed, I must say. Seldom do I encounter a blog that?s equally educative and interesting, and without a

doubt, you have hit the nail on the head. The issue is something

not enough folks are speaking intelligently about.

I am very happy that I came across this in my search for

something regarding this.

FAFA855

June 27, 2021My brother recommended I might like this web site. He was entirely right.

This post actually made my day. You can not believe just how

much time I had spent for this info! Thank you!

Togel Online

June 27, 2021Able to go on a tour of untamed Africa?

Feel free to surf to my website: Togel Online

เครดิตฟรี 50 ไม่ต้องฝากไม่ต้องแชร์

June 27, 2021Hey there! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords

but I’m not seeing very good results. If you know of any please

share. Kudos!

i can't write my essay reddit

June 27, 2021woww very interesting article and very helpful for students

awareness คือ

June 27, 2021Hey! This is kind of off topic but I need some advice from an established blog.

Is it hard to set up your own blog? I’m not very techincal

but I can figure things out pretty quick. I’m thinking about setting

up my own but I’m not sure where to begin. Do you have any points or

suggestions? Cheers

fun88

June 27, 2021Hey very interesting blog!

titan gel

June 27, 2021Tụi em chỉ chào bán hàng qua mạng thôi” – người chủ số điện thoại

nói.

모바일 카지노 게임

June 27, 2021I take pleasure in, lead to I found just

what I was taking a look for. You’ve ended my four day

long hunt! God Bless you man. Have a nice day.

Bye

write my essay online free

June 27, 2021Ahahahahasame

Sửa Tủ Lạnh Không Xả Tuyết

June 27, 2021Nên liên hệ dịch vụ chuyên sửa tủ

lạnh uy tín để được bảo đảm an toàn.

สมัคร 1xbet

June 27, 2021It’s going to be end of mine day, but before finish I am reading this enormous post to improve my experience.

botoks fiyatları

June 27, 2021Hi, I do believe this is an excellent site. I stumbledupon it 😉

I may come back once again since I book-marked it.

Money and freedom is the best way to change,

may you be rich and continue to guide other people.

Click here to continue...

June 27, 2021Please let me know if you’re looking for a article writer

for your weblog. You have some really good posts and I think I would be

a good asset. If you ever want to take some of the load off, I’d love to write

some content for your blog in exchange for a link back to mine.

Please send me an e-mail if interested. Thanks!

happyluke

June 27, 2021At this time I am ready to do my breakfast, after having my breakfast coming again to read other news.

แทงหวยหุ้นนิเคอิ

June 27, 2021Pretty section of content. I simply stumbled upon your website and in accession capital to assert that I acquire in fact enjoyed account your blog posts.

Anyway I’ll be subscribing on your augment

or even I success you get admission to consistently quickly.

zagrebie01

June 27, 2021What a material of un-ambiguity and preserveness of valuable experience concerning unpredicted feelings.

Feel free to surf to my page: zagrebie01

188bet

June 27, 2021No matter if some one searches for his essential thing, so

he/she wishes to be available that in detail, so that thing is maintained

over here.

zagrebie01

June 28, 2021Your mode of explaining all in this article is truly good,

every one can without difficulty be aware of it, Thanks a lot.

Feel free to visit my web page; zagrebie01

ppslot

June 28, 2021Wow that was odd. I just wrote an really long comment but after I clicked

submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Regardless,

just wanted to say wonderful blog! ppslot

zagrebie01

June 28, 2021Whoa! This blog looks exactly like my old one! It’s on a completely different subject but it has pretty much the same page layout and design. Superb choice

of colors!

Take a look at my web page zagrebie01

zagrebie01

June 28, 2021I like the helpful info you provide on your articles.

I will bookmark your blog and test again here frequently.

I’m moderately certain I will be informed many new stuff proper right here!

Best of luck for the following!

Visit my website; zagrebie01

slot online

June 28, 2021Any fashionable online slot comes with prompt play.

Feel free to surf to my web-site :: slot online

ทางเข้า happyluke

June 28, 2021Hi I am so thrilled I found your website, I really found you by

mistake, while I was looking on Google for something else, Anyways I am here now and