Table of Contents

What Is The BCG Matrix?

What are the four quadrants of the BCG Matrix?

How to use the BCG Matrix model

The Four Quadrants Explained

Dog products

Question mark products

Star products

Cash cow products

Advantages and disadvantages of the BCG Matrix

BCG Matrix Example

How the BCG Matrix Fits With Other Forms of Analysis

Related Posts

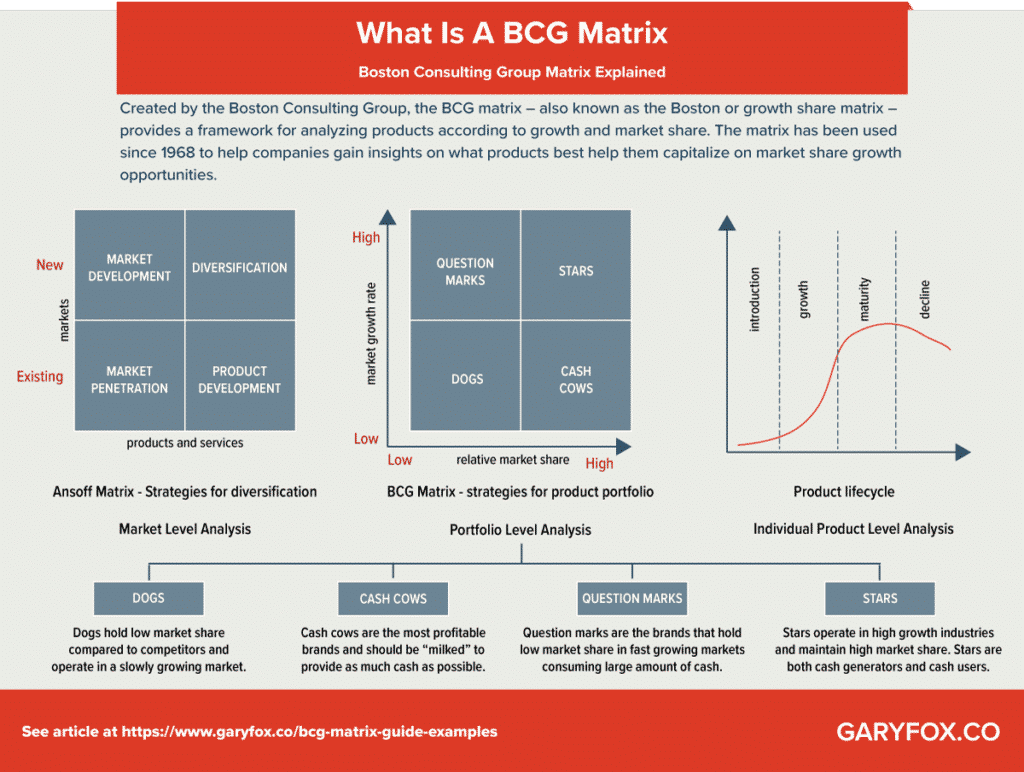

What Is The BCG Matrix?

What are the four quadrants of the BCG Matrix?

Dogs: These are products with low growth or market share.

Question marks or Problem Child: Products in high growth markets with low market share.

Stars: Products in high growth markets with high market share.

Cash cows: Products in low growth markets with high market share

How to use the BCG Matrix model

The Boston Consulting Group’s product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue or develop products. It’s also known as the Growth/Share Matrix.

The Matrix is divided into 4 quadrants. Each quadrant represents a relative position based on market growth and relative market share.

The BCG is more relevant to larger organizations with multiple services and markets. However, smaller businesses that have a broad range of products can use this to analyse their products.

Often the 80:20 rule applies. In other words, eighty per cent of profits come from twenty per cent of the products and therefore the BCG matrix provides a method to analyse your portfolio and decisions.

The Four Quadrants Explained

Think of the BCG Matrix as mapping a portfolio of products or services.

Dog products

The recommended advice is to remove any dogs from your product portfolio as they are a drain on resources.

However, this can be an over-simplification since it’s possible to generate ongoing revenue with little cost. For example, in the automotive sector, when a car line ends, there is still an after-market i.e. the need for spare parts. After SAAB ceased trading and producing new cars, a whole business emerged providing SAAB parts.

Question mark products

As the name suggests, these products often require significant investment to push them into the star quadrant. The challenge is that a lot of investment may be required to get a return. For example, Amazon (see the Amazon business model)developed the Firephone but failed to gain traction in the smartphone market. Despite a serious amount of investment, it flopped and failed to compete against the established players such as Apple and Samsung.

Star products

Can be the market leader though require ongoing investment to sustain. They generate more ROI than other product categories.

Cash cow products

The simple rule here is to ‘Milk these products as much as possible without killing the cow! Often mature, well-established products. The company Procter & Gamble which manufactures Pampers nappies to Lynx deodorants has often been described as a ‘cash cow company’.

Advantages and disadvantages of the BCG Matrix

Benefits of the matrix:

- Easy to perform;

- Helps to understand the strategic positions of a business portfolio;

- It’s a good starting point prior to further analysis.

Growth-share analysis oversimplifies the factors involved in assessing the future of a business portfolio. Some other limitations include:

- Business can only be classified to four quadrants. It can be confusing to classify an SBU that falls right in the middle.

- It does not define what ‘market’ is. Businesses can be classified as cash cows, while they are actually dogs, or vice versa.

- Does not include other external factors that may change the situation completely.

- Market share and industry growth are not the only factors of profitability. Besides, high market share does not necessarily mean high profits.

- It denies that synergies between different units exist. Dogs can be as important as cash cows to businesses if it helps to achieve competitive advantage for the rest of the company.

BCG Matrix Example

The BCG Model is based on products rather than services, however, it does apply to both. You could use this if reviewing a range of products, especially before starting to develop new products.

Looking at the British retailer, Marks & Spencer, they have a wide range of products and many different lines. We can identify every element of the BCG matrix across their ranges:

- Stars

Example: Lingerie. M&S was known as the place for ladies underwear at a time when choice was limited. In a multi-channel environment, M&S lingerie is still the UK’s market leader with high growth and high market share.

- Question Marks/Problem Child

Example: Food. For years M&S refused to consider food and today has over 400 Simply Food stores across the UK. Whilst not a major supermarket, M&S Simply Food has a following which demonstrates high growth and low market share.

- Cash Cows

Example: Classic range. Low growth and high market share, the M&S Classic range has strong supporters.

- Dogs

Example: Autograph range. A premium-priced range of men’s and women’s clothing, with low market share and low growth. Although placed in the dog category, the premium pricing means that it makes a financial contribution to the company.

You can also apply the BCG model to areas other than your product strategy.

For example, we developed this matrix as an example of how a brand might evaluate its investment in various marketing channels. The medium is different, but the strategy remains the same- milk the cows, don’t waste money on the dogs, invest in the stars and give the question marks some experimental funds to see if they can become stars.

How the BCG Matrix Fits With Other Forms of Analysis

The BCG Matrix is a portfolio level of analysis. The two other types of analysis related to this are the Ansoff Matrix and the product lifecycle.

Source : garyfox